First Financial Provides Record Levels of New Automation Technology Financing

Today’s e-commerce driven economy is placing a massive burden on distribution centers and warehousing systems, which is being further strained by labor limitations. As online shopping continues to skyrocket, supply chains are suffering severe disruptions. Businesses are working desperately to keep pace with increasing customer demand, while maintaining a safe work environment for their employees.

By leveraging automation solutions, managers at distribution centers and warehouses can increase accuracy and productivity, operate more efficiently, expand faster and ultimately better serve their customers. Although these operational benefits and financial justifications are obvious, many businesses continue to delay essential projects and capital equipment expenditures.

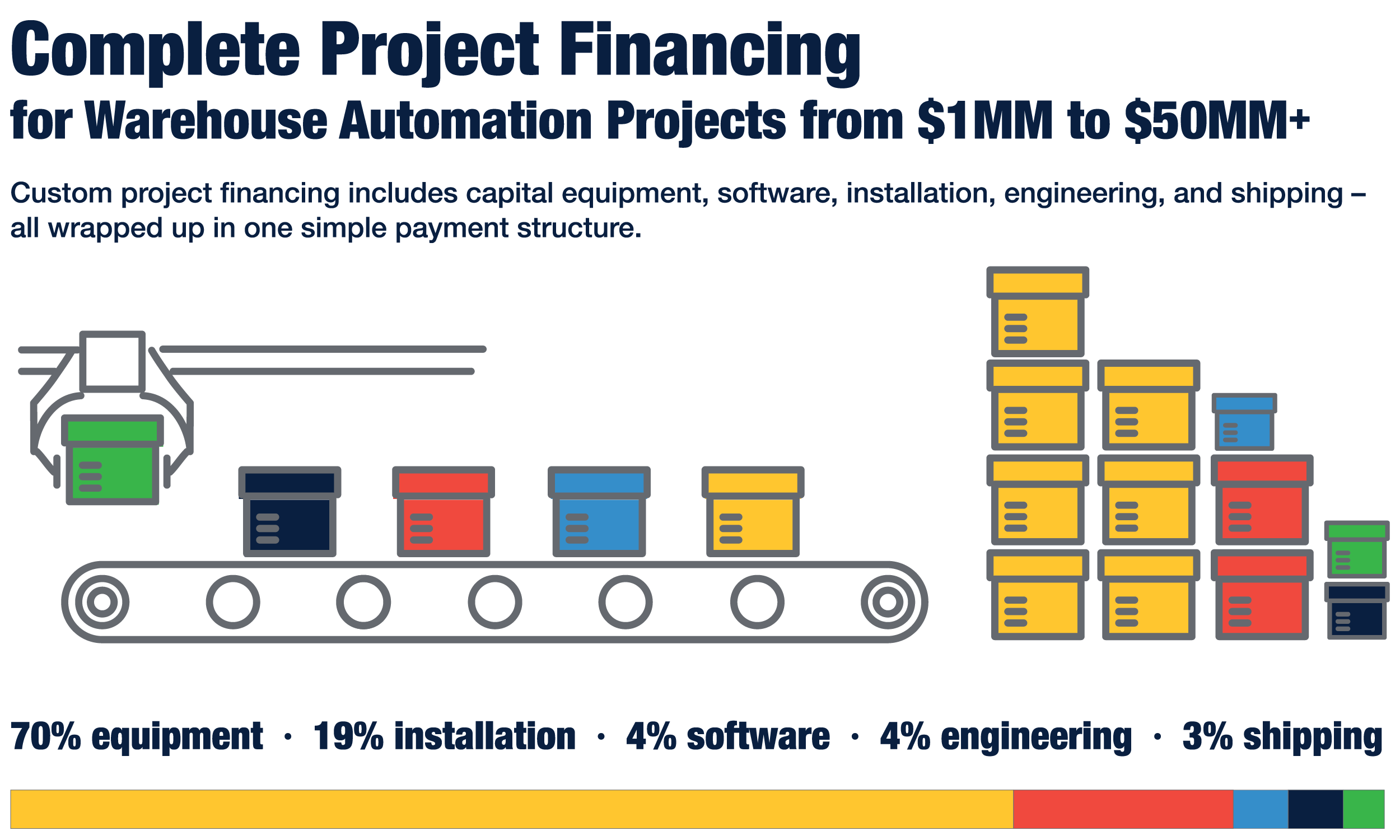

Cost is most often the biggest barrier keeping companies from modernizing warehouses with automation solutions and robotics. Automation integrations can require large upfront payments resulting in many years until positive ROI is achieved due to the hefty price tag – particularly when considering significant costs for installation, engineering, and software. Given today’s economic challenges, traditional lenders and banks have severely tightened their lending parameters, making it tricky to secure funding for extensive projects.

Maintaining Liquidity Through Leasing

Despite the challenges presented by the pandemic, we are seeing companies utilize lease financing to forge ahead with procurement of capital equipment and automation projects – just about everything inside the four walls of their distribution centers and warehouses.

Over the last year alone, First Financial’s investments in automation and material handling equipment have jumped over 30% from the prior year. By working with First Financial to lease their automation projects, many businesses often realize a “day one” savings as the operational benefits exceed the monthly cost of a lease. For unlike a cash purchase or bank loan, First Financial’s leasing solutions provide 100% financing – covering all project costs and eliminating the need for large upfront payments. First Financial makes all initial upfront progress payments, so the customer does not start paying for new automation and material handling solutions until after the project has been implemented and is fully operational.

Capitalizing on the Benefits of Automation Through Leasing

Most recently, First Financial assisted a leading consumer goods company with over $11B in sales avoid an outlay of $27MM for new AGVs and robotics. To keep up with growing consumer demand for their products, the company needed to modernize two distributions centers. Their current facilities operated manually and were highly labor intensive.

The objectives were to implement new equipment and technology tools that would improve operational efficiency, and significantly reduce labor costs. It also required a substantial financial investment, and leasing was a better source of capital than using internal funds.

First Financial stepped in and developed a financing solution that provided 100% financing. This helped the business avoid $27MM in upfront costs for the equipment, and save their working capital for more immediate, short-term needs. First Financial also coordinated with all vendors, manufacturers, and integrators involved in the massive project to make sure all were paid on time.

During the course of the integration – from conception, processing, delivery, to installation – First Financial made all upfront deposits, and covered all costs. This created an enormous day one savings for our customer and offered an immediate return on investment. If the customer had been required to make an up-front capital outlay, it could have taken them several years to realize any ROI.

By moving from labor intensive manual processes to fully automated facilities, the company increased the efficiency of their operations while simultaneously reducing costs. Through the use of AGVs and robotics, the company is expecting to decrease the cost of distribution by as much as 60%. Even more noteworthy, is the anticipated 90% reduction in their workforce the customer hopes to achieve by embracing the right technology solutions to automate their distribution centers.

Automating warehouse and distribution center processes can be transformative for any business, and First Financial’s project financing expertise can make automating attainable and affordable. While there are many factors to consider when making the move to automation, figuring out how to afford the project should not be one of them. Through our lease financing programs, we can equip any business for success by keeping working capital where it is needed most. If you are looking to conserve cash and bring predictability to expenses while moving forward with your automation projects, First Financial is here to help.