The equipment dealership landscape is poised for a monumental shift in 2025, particularly for forklift sellers, thanks to the One Big Beautiful Bill Act. With substantial updates to Section 179, dealers now have a powerful tool to enhance sales, educate customers, and ultimately increase profitability.

Understanding Section 179

At its core, Section 179 is a crucial part of the U.S. tax code that allows businesses to fully deduct the cost of qualifying equipment, such as forklifts, in the same year it is placed in service. This means buyers can write off the total purchase amount immediately, rather than spreading deductions over 5 to 7 years.

What’s New for 2025? Several key updates to Section 179 have been set to take effect:

- Deduction Limit: The deduction limit has been doubled to an impressive $2.5 million.

- Phase-Out Threshold: The phase-out threshold has been raised to $4 million, allowing more businesses to benefit from these tax advantages.

- 100% Bonus Depreciation: The reinstatement of 100% bonus depreciation is another significant change.

- Equipment Eligibility: These updates apply to both new and used equipment, including leased equipment.

Why Leasing Forklifts is Beneficial – Leasing forklifts provides maximum flexibility and tax efficiency—advantages that shouldn’t be ignored:

- Preserve Cash Flow: Leasing enables businesses to manage their cash flow with lower monthly payments.

- Full Section 179 Deduction: Businesses can qualify for the full Section 179 deduction, even if they choose to lease.

- Avoid Debt on Balance Sheet: Leases are often categorized as operating expenses, helping businesses avoid adding more debt to their balance sheets.

- More Interest Deductions: Leasing offers the potential for additional interest to be written off, improving overall financial efficiency.

High-Value Examples: Demonstrating the Benefits of Leasing

Example 1: Leasing $1.5 Million Worth of Forklifts

Imagine a customer who leases forklifts valued at $1.5 million. Under Section 179, they can deduct the entire amount in the same tax year, even though they are only making monthly lease payments. At a 35% tax rate, this could yield $525,000 in tax savings—funds that can be reinvested in their business.

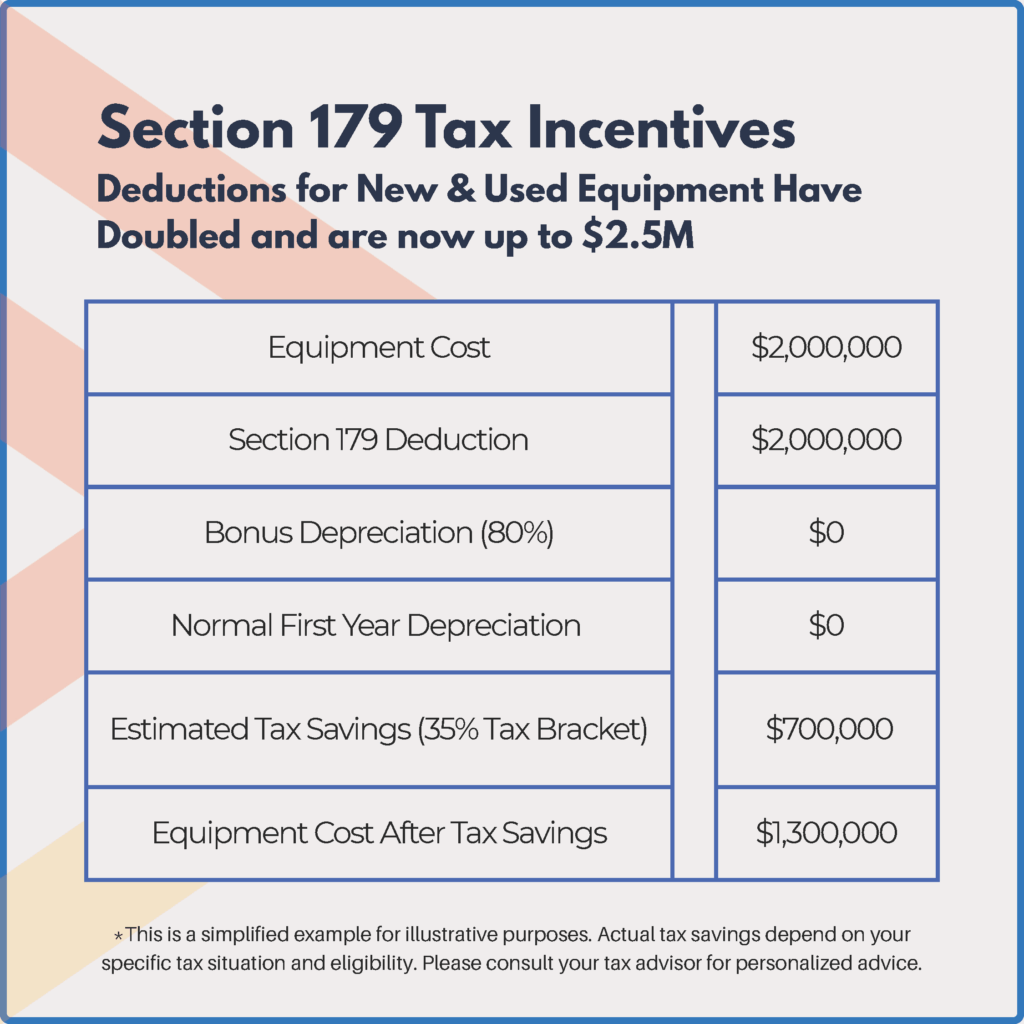

Example 2: Leasing $2 Million Worth of Forklifts

Consider a larger operation that leases $2 million worth of forklifts. Using Section 179, they can also deduct the full amount in the acquisition year, leading to $700,000 in tax savings at a 35% tax rate. Leasing not only preserves their capital but also maximizes deductions, demonstrating a smart financial strategy.

How This Framework Helps Dealers Sell More Forklifts

The new tax incentives create a sense of urgency among customers to act before December 31, 2025, to claim their deductions. Leasing forklifts makes them more affordable and accessible, allowing dealers to close deals more effectively. By showcasing the immediate return on investment (ROI), dealerships can position themselves as trusted advisors.

Industry Insight: Expected Rise in Forklift Sales

Forecasts indicate that forklift sales are projected to grow by 8 to 12% in Q4 2025, driven by purchasing behavior influenced by the Section 179 tax deduction. Dealers who proactively educate their customers will have a competitive edge.

Educating Your Sales Force is Essential

Equip your team to maximize these opportunities with:

- Training Sessions: Provide comprehensive training on Section 179 and the benefits of leasing.

- Sales Scripts: Develop guides for effectively addressing customer objections.

- Customer-Facing Resources: Create flyers and calculators to simplify decision-making for clients.

- Role-Playing Scenarios: Build confidence among your team through interactive training.

Key Talking Point for Sales Teams:

“Did you know you can lease this forklift and still deduct the full cost this year? It’s a smart way to save cash and reduce your tax bill.”

Ready to Equip Your Dealership?

Section 179 is more than just a tax break; it’s a powerful sales accelerator for dealerships. By taking the initiative to educate your team and customers about these updates, you can transform legislation into a significant competitive advantage. Now is the time to seize the opportunities presented by these changes and strategically position your dealership for success in 2025.

Don’t wait! Start educating your team today and seize the opportunity to enhance your sales strategy. Contact me to learn more about how you can leverage Section 179 to benefit your dealership.

Elise Hardy, ehardy@ffequipmentleasing.com, 410-428-1315