Maximize Tax Savings While Buying New or Used Equipment Through Section 179 Tax Incentives

Maximize Tax Savings While Buying New or Used Equipment Through Section 179 Tax Incentives

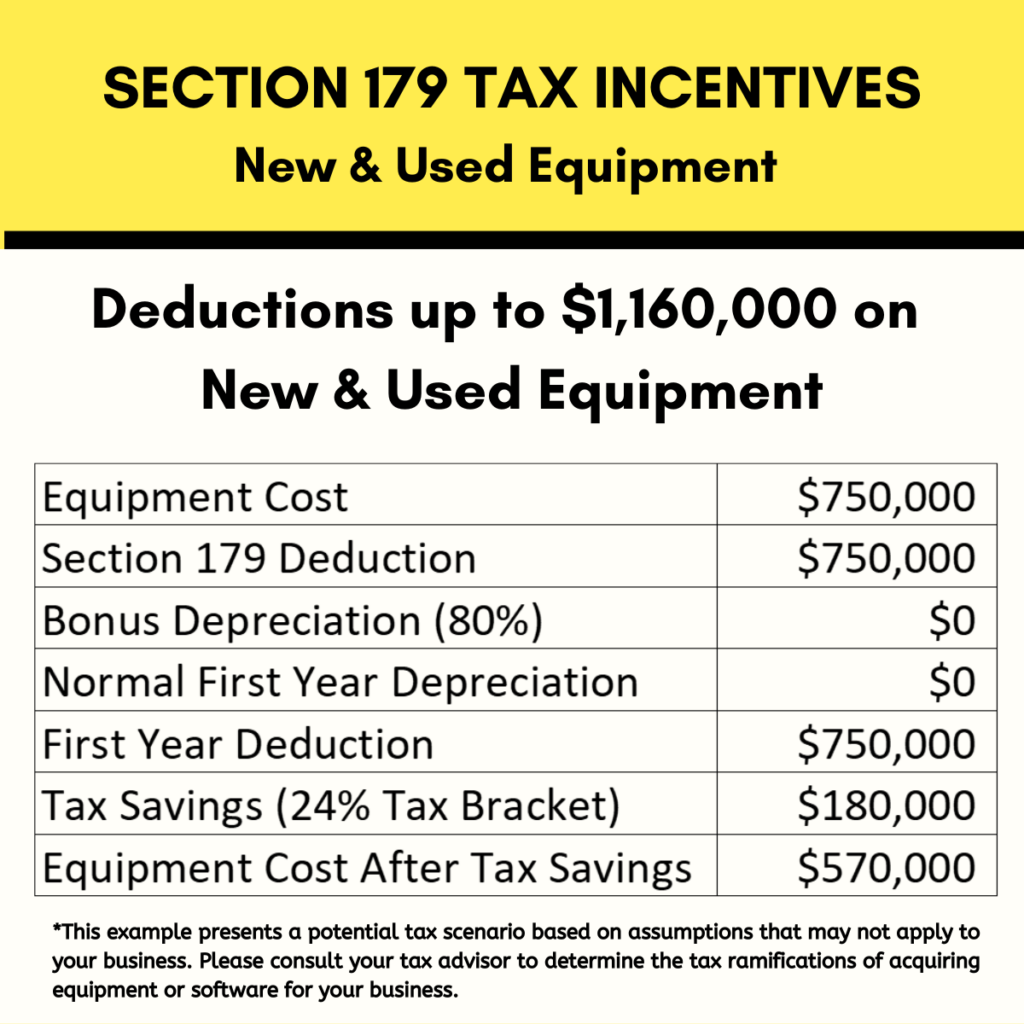

Maximizing your tax savings is always a smart financial decision, and the Section 179 tax incentives for fixed assets make it easier than ever to do so while purchasing new or used capital equipment. By taking advantage of this rule, you can expense 100% of the cost of capital equipment (up to $1,160,000) in the first year, allowing you to reap the benefits of significant tax deductions.

Unlike traditional depreciation methods, Section 179 lets you take the entire depreciation deduction in a single year, which can help you reduce your tax burden significantly. This means that you can deduct the full cost of your new or used qualifying equipment in the year it is purchased instead of deducting its value over the course of several years. The practice of first-year expensing is a great way to save money and reduce your tax bill.

It’s worth noting that Section 179 applies to both new and used qualifying equipment as long as it is new to you. It doesn’t matter if you borrow, lease, or pay cash for the equipment as long as it is placed into service before the end of 2023. This rule applies to different types of equipment, including construction and heavy equipment, tractor-trailers, computers, office equipment, and software.

The maximum amount that can be deducted in 2023 is $1,160,000, which is an increase of $80,000 from 2022. The maximum amount of equipment purchased (and take the full deduction) is $2.8 million. With these tax incentives for fixed assets, you can rest assured that you’re making a smart financial decision while reducing your tax liability.