The Big Beautiful Bill Has Arrived

HERE’S HOW TO HELP YOUR SALES FORCE CAPITALIZE ON IT

––––––––––––––––

JEFF WHITCOMB

Senior Vice President Construction, First Financial Equipment Leasing

––––––––––––––––

Jeff Whitcomb has over 25 years of experience in equipment leasing and sales leadership. Throughout his career, he has demonstrated expertise as an entrepreneur, establishing new companies with strong cultures, as well as taking on challenges at large multinational organizations. His extensive industry knowledge and broad network have consistently yielded positive results. Jeff is particularly adept at mentoring others to help them expand their capabilities, whether they are clients or colleagues.

Before joining First Financial in 2021, Jeff held various sales and sales management positions at eMarket Capital, De Lage Landen Financial Services, People’s Capital and Leasing Corp., ampCNG, Sumitomo Mitsui Finance and Leasing, Mitsubishi UFJ Lease & Finance, and Pathward.

Jeff earned a B.S. degree in business administration from Bucknell University and an M.B.A. from the Thunderbird School of Global Management at the University of Arizona. He resides in Dallas, Texas.

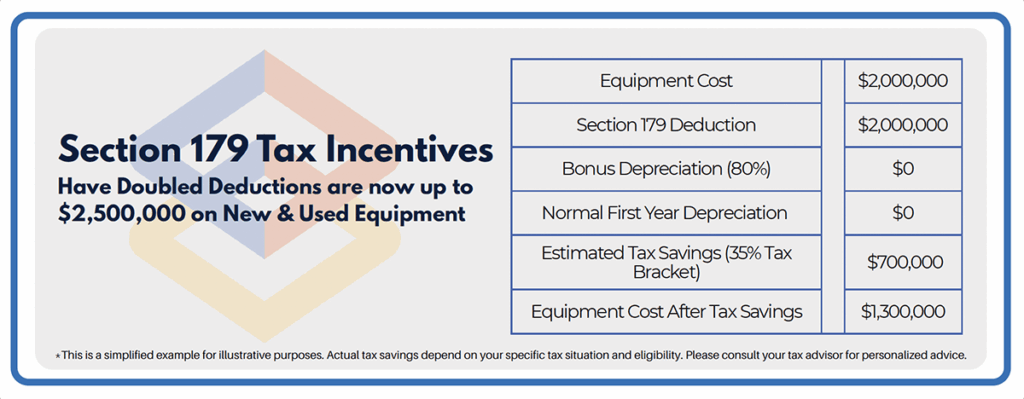

Section 179 changes allow businesses to deduct up to $2.5 million from their tax bill this year; that is a win-win proposition for you and your customers.

The Big Beautiful Bill has been signed into law, and it’s the biggest incentive for equipment sales our industry has ever seen. With the passage of this new bill, equipment distributors now have one of the most essential elements for success: clarity.

Now is the time to arm your sales force with clear, practical information to ensure that they can fully communicate the tremendous opportunity customers have to invest in their future and take full advantage of these tax incentives.

Let’s peel back the layers to understand what’s in the Big Beautiful Bill that benefits your customers:

IT DOUBLES THE SECTION 179 EXPENSING ALLOWANCE TO $2.5 MILLION IN 2025, WITH A $4 MILLION PHASEOUT INDEXED TO INFLATION FOR FUTURE YEARS.

Section 179 of the Internal Revenue Code allows businesses to deduct the full purchase price of qualifying equipment or software in the year it is put into service. Therefore, rather than spreading out deductions over several years, businesses are permitted to claim the entire expense up front, which can significantly reduce their overall tax bill.

The $4 million phaseout threshold means the deduction is reduced dollar- for-dollar above and beyond this limit. It’s intended to benefit small to mid- sized businesses rather than larger companies with deeper pockets.

Both new and used equipment are eligible for the deduction, provided the equipment is new to the business.

It doesn’t matter if businesses borrow, lease or pay cash for the equipment as long as it is placed into service before the end of 2025. This rule applies to different types of equipment, including construction and heavy equipment, tractor-trailers, computers, office equipment and software.

IT PERMANENTLY REINSTATES THE 100% BONUS DEPRECIATION FOR NEW AND USED EQUIPMENT PURCHASES, RETROACTIVE TO JAN. 19, 2025.

Businesses can immediately deduct the entire cost of qualifying new and used equipment placed in service after Jan. 19 of this year. And this is now a lasting part of the tax code and won’t be subject to future reductions or expirations, thus providing businesses with ongoing tax benefits.

BUSINESS INTEREST DEDUCTION LIMIT TO 30% OF EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION (EBITDA), RATHER THAN EARNINGS BEFORE INTEREST AND TAXES (EBIT).

This reverses a change made in 2022 and is advantageous for businesses that rely heavily on loans and have significant depreciation and amortization expenses. It allows them to deduct more interest, reducing their tax burden and encouraging investment.

HOW DOES THIS IMPACT LEASING?

One of the biggest questions I’m asked is, Can you still take bonus depreciation and/or Section 179 benefits (accelerated depreciation) when you choose a First Amendment Lease? The answer is YES.

And that’s an amazing thing, because leasing can help customers level up the economic value proposition. Leasing allows customers to take advantage of these significant tax incentives with the least amount of up-front capital expenditures (so less cash out of pocket). Leasing is still the lowest overall total cost of ownership for lessees who return or extend their leases.

Businesses can also wrap software, maintenance and supplies into their lease. This can help sidestep surprises, minimize downtime and transfer the burden of maintenance costs away from the company, while helping ensure that equipment stays in tip-top condition throughout the lease term.

DEVISING A WINNING SALES TALK TRACK

What does passage of the Big Beautiful Bill mean for your customers? One word: MORE. More lucrative tax benefits, more preservation of capital, and more opportunities for customers to further their business goals and drive growth.

And it’s ushering in much more opportunity for your sales force, as these new benefits give them more ammunition to counter the most common objections. In fact, it gives you a huge opportunity to wipe out a whole slew of these objections in one fell swoop.

It’s important to have a town hall / family meeting to walk through some practical information that your sales force can use when they get on a call with a contractor. This will help them know what to key in on, so they are equipped with a laser-focused talk track.

What should that talk track look like? We think something like this:

YOUR EQUIPMENT IS TOO EXPENSIVE.

Response: What we now have in place is like the ultimate rebate scheme. You can immediately recoup the full cost of the equipment you buy through tax deductions this year. Everyone’s going to want to get in on this.

WE AREN’T READY TO PURCHASE/LEASE RIGHT NOW.

Response: If you had planned to purchase or lease some equipment in 2026, there’s now a good reason to move your timeline

this new legislation and tax benefits.

Be decisive. Take advantage of this opportunity, because if you don’t, your competitors will, and then you may be at a disadvantage.

WE WANT TO PAY CASH.

Response: I understand you think paying cash makes sense, and maybe you’ve always done it that way, but we’re entering a new environment. There are going to be opportunities for you to buy other companies, maybe a competitor, or start a new line of business, and you’ll want to have the cash to make that investment, because you’ll earn way more from that investment. Keeping your options open – and your cash on hand – is the smarter business strategy.

I NEED TO TALK TO MY BUSINESS PARTNER.

Response: Good, because I guarantee you, your tax accountant is going to love this strategy! Your CPA can confirm that you need to acquire as much equipment as possible by the end of the year to equip your business for success and minimize your taxes.

The Big Beautiful Bill is about to benefit your business – and your customers – in a really big way, and the timing couldn’t be better, as budget cycle planning is about to go into full swing.

–––––––––––––

AED Magazine Article published August 2025