Elevate Your Business with FMV Leases

Secure the essential equipment you need without depleting your capital. Take charge of your growth with our affordable financing solutions.

What is an FMV Lease?

A Fair Market Value (FMV) lease is a type of operating lease that allows businesses to use equipment for a specified period without paying the full purchase price upfront. Instead, you pay for the portion of the equipment’s value used during the lease term. At the end of the lease, you have three options:

Return the equipment and upgrade to newer technology.

Renew the lease for continued use.

Purchase the equipment at its fair market value.

This flexibility makes FMV leasing ideal for businesses that want access to the latest equipment without tying up capital in ownership.

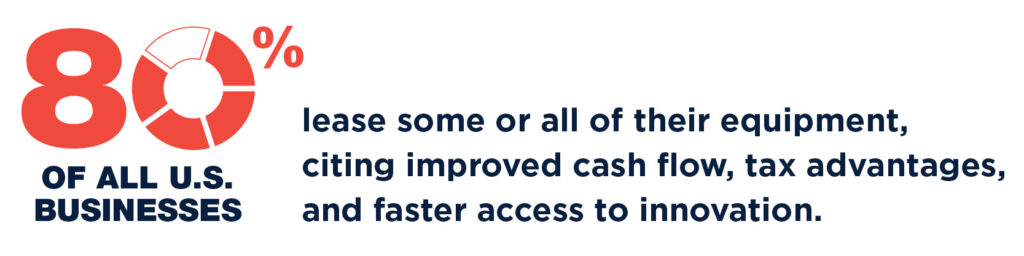

Why FMV Leasing Matters

FMV leasing is not just a financing tool; it provides a strategic advantage. Here are the key reasons why it matters:

- Capital Conservation: It helps avoid large upfront costs, allowing you to keep cash available for growth initiatives.

- Operational Agility: You can upgrade equipment as technology advances, ensuring you remain competitive.

- Tax Efficiency: Lease payments are considered operating expenses, providing immediate tax deductions.

- Balance Sheet Benefits: Operating leases do not appear as long-term debt, which can improve your financial ratios.

- Predictable Budgeting: Fixed monthly payments make cash flow planning simpler.

FMV Leasing vs Buying Equipment

Leasing has evolved into a highly effective strategic financial tool rather than merely a backup option. Although owning equipment outright can seem desirable, it often locks up valuable capital and introduces risks associated with depreciation and maintenance. By choosing to lease, businesses can preserve their cash flow, seamlessly upgrade their equipment, and mitigate concerns about obsolescence.

For companies navigating fast-paced and dynamic environments, leasing is not just an affordable choice; it plays a crucial role in enhancing agility and positioning for sustainable growth. Embracing leasing can empower businesses to adapt more swiftly to changes and seize new opportunities.

Financing Option

FMV Leasing

Buying Equipment

Upfront Cost

No down payment; 100% financing available

Large upfront capital investment required

Capital Conservation

Preserves cash for growth, R&D, and operations

Ties up capital in equipment ownership

Technology Access

Easy upgrades to the latest equipment

Depreciation over 5–7 years; complex accounting

Tax Treatment

Lease payments are tax-deductible operating expenses

Depreciation over 5–7 years; complex accounting

Balance Sheet Impact

An operating lease is typically off-balance sheet

Equipment appears as an asset; a loan as a liability

Cash Flow Predictability

Fixed monthly payments simplify budgeting

Variable costs for maintenance and repairs

Risk Management

Ownership risk (resale, obsolescence) is handled by the lessor

Business bears the full risk of equipment value decline

Speed of Acquisition

Quick approvals (often 1–2 days)

Longer approval process for loans or capital allocation

End-of-Term Options

Return, renew, or purchase at fair market value

No flexibility: asset disposal is your responsibility

Who Should Consider FMV Leasing?

FMV leasing offers advantages to various industries and roles, including:

- Equipment Dealers & Distributors: Provide leasing options to customers to finalize more deals.

- Manufacturers & Contractors: Acquire heavy machinery without depleting capital.

- Healthcare Providers: Stay up to date with advancements in medical technology.

- IT & Automation Companies: Prevent obsolescence in rapidly evolving tech environments.

Industries We Serve

Healthcare

Patient care matters most. Our team of experts makes it easy for you to acquire the equipment and leasing strategy you need.

Material Handling & Automation

When you’re ready to

transform your business, we’ll be there to help fund your

future.

Technology

Keep your business moving forward with our Technology Asset Refresh programs and lease virtually any IT product and solution.

Construction

Specialized commercial equipment financing throughout the US, Canada, and Mexico

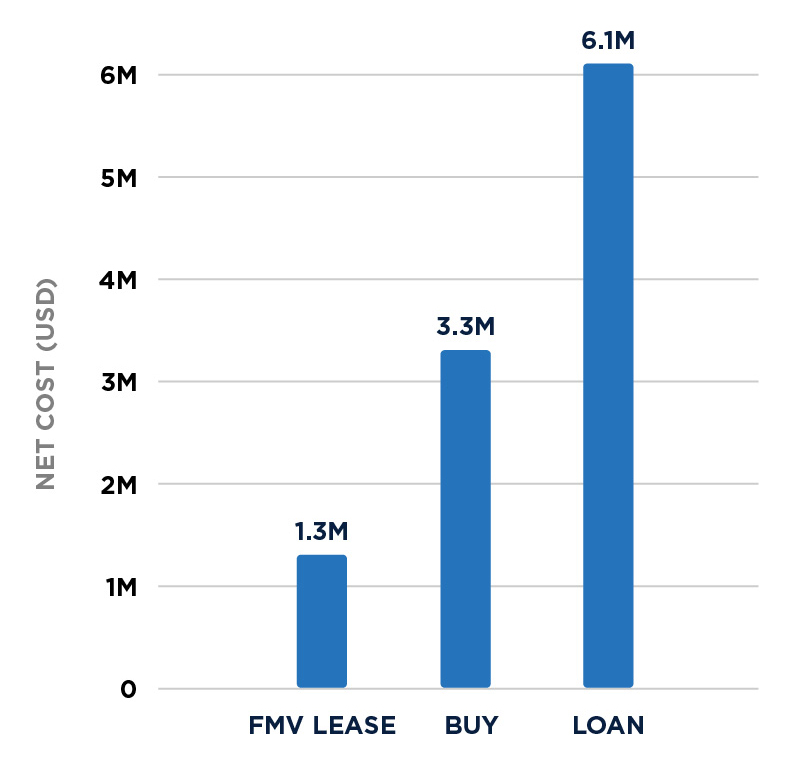

Cost Comparison

5-Year Cost Comparison for $5 million in Equipment:

Consider how to finance $5,000,000 worth of advanced capital equipment.

There are three options to evaluate: cash purchase, loan financing, and an FMV lease.

Here’s how each option compares:

FMV Lease Net Cost: $1,312,500

Buy Net Cost: $3,250,000

Loan Net Cost: $6,125,000

Key Insights:

- Cash purchase ties up significant capital and limits flexibility.

- Loan financing reduces upfront strain but locks the company into ownership, exposing it to depreciation and maintenance costs.

- FMV lease offers predictable payments, tax benefits, and upgrade options—ideal for tech-driven environments where agility matters most.

Ready to explore tailored leasing solutions?

Partner with a financing provider that understands your industry and helps you stay ahead. Contact us today to transform your operations with smart, flexible financing.